Advocacy

Governor Newsom signs SB 361, AB 566, AB 656, and SB 446, advancing browser controls, data broker transparency, social media account deletion, and breach notification

Advocacy

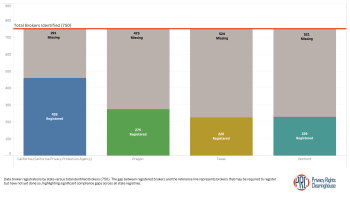

Hundreds of data brokers have not registered with state consumer protection agencies. These findings come as more states are passing data broker transparency laws that require brokers to provide information about their business and, in some cases, give consumers an easy way to opt out.

Advocacy

We are joining 40+ consumer, civil rights, housing, and privacy organizations in urging the Consumer Financial Protection Bureau to maintain and continue its Consumer Complaint Intake System in the face of pressures to eliminate this vital consumer protection tool.

Reports

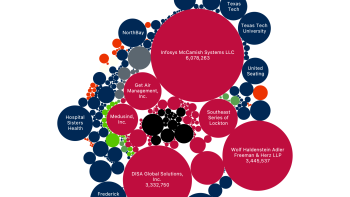

Our May 2025 update—the fifth this year—brings our complete data through May along with this focused analysis of Q1 breach statistics. The first quarter saw 876 new breach notifications representing 658 distinct security incidents that impacted over 32 million people.

Advocacy

We're proud to stand with Consumer Reports in supporting Senator Becker's SB 361 to improve the registration and transparency requirements of the California Delete Act.

Q&A

If you're a survivor of domestic violence, both federal and state laws offer important privacy protections to help keep you safe in your housing.

Q&A

As biometric entry systems like facial recognition become more common in housing, it's important to know your rights when your landlord wants to install one.

Q&A

While landlords have legitimate reasons to protect their property, they shouldn't be spying on you.